A Study of the level of disclosure practices of Green Accounting of the

Corporate Sector of Sri Lanka

ABSTRACT

Today

many companies in the world show their corporate social responsibility by their

duty to the environment. This can be identified as a positive measure towards a

better place to live as during the past few decades the earth has been severely

damaged by the rapid industrialization of the world. This study will analyze

the amount of disclosure of Green Accounting practices in the corporate sector

of Sri Lanka.

Green

Accounting although an emerging trend in the worldwide arena of Accounting, is

still a very novel concept in the infancy stage to the Sri Lankan Public. Only

a handful of organizations can be identified as organizations which disclose

green accounting data.

The

disclosure of practices of Green Accounting practices will be tested against

appropriate variables to incur an understanding about organization demographics

relating to better disclosure of Green Accounting practices

Relevant

research to Sri Lankan context haven’t been heard of, therefore this study will

be a significant study for the government as well as corporate organizations

1. OVERVIEW OF THE STUDY

1.1 Introduction to the study

Environmental

protection is one of the most pressing concerns of this millennium and

according to Dillard et al the widespread

industrial growth and expansion through-out the world have resulted in environmental

issues becoming major societal risk factors. As a result Government

intermediaries, and communities in both developed, and developing nations have

recently begun paying greater attention to environmental issues. Jahamani (2003)

critically argues that developed nations such as the US and UK have greatly

contributed towards its environment both theoretically and practically. However

not all countries are equally environmental friendly and this is depicted

through their environmental policies and regulations. Nevertheless,

Alagan(2010) states that Sri Lanka makes a great effort to safeguard its

environment in comparison to its South Asian neighbors.

Stanojevic, Vranes and Gokalp (2010) mentions that “The

first step towards the widespread use of renewable energy and

preservation of our environment for the people of the future is to adopt the green

accounting standards that translate socially and environmentally responsible

behavior into monetary terms, the only language businesses understand”

“The Institute of Management Accountants in the USA defined environmental

accounting as the identification, measurement, and allocation of environmental

costs, the integration of these environmental costs into business decisions,

and the subsequent communication of the information to a company’s

stakeholders” (Jahamani, 2003). Hossain, Islam and Andrew (2006),

in their study about the level of green accounting disclosures in the corporate

sector in Bangladesh critically argues that corporate environmental disclosure

may not apply universally to all organizations as one organization’s attitude

and awareness towards environmental disclosure practices may differ from another.

Rajapakshe (2003) in his study about the environmental reporting practices

in Sri Lanka concluded that Green Accounting best practices were inconspicuous

in Sri Lanka. However today following the Global Reporting Initiative

guidelines, many top Sri Lankan companies such as Dialog Telecom PLC, Aitken

Spence Holdings, Sri Lanka Telecom PLC, Hatton National Bank, Ceylon Tobacco

Company and NDB Bank disclose environmental information in their Annual Reports

where they disclose their policy and accountability towards the environment.

Their commitment to the area of Green Accounting has been rewarded by the ACCA

Sri Lankan Awards for sustainability reporting since year 2005. However the

biggest challenge in implementing Green Accounting to the corporate sector lies

in fact that there may be several barriers blocking such policies. The tension

between the environmental protection and economic development may give rise to

issues as changes Sri Lankans are believed to be very resistant towards changes

in social attitudes.

“Although Sri Lanka has a good record in environmental education, the Asian

region still lacks the political will and commitment to protect its environment.”(Alagan,

2010) Therefore it is mandatory that necessary measures should be followed to

implement Green Accounting to the corporate sector of Sri Lanka as it may

benefit the sustainable development of the country beyond measures.

1.2 Problem Statement

Green

Accounting is the concept of recognizing the contribution of the environment to

the country’s economic growth. It is considered to be allocation and

identification of the environment costs used in business procedures, and the

integration of these costs into business decisions while communicating such

environmental information to company stakeholders. Although much practiced in

the Western and American worlds, it is a considerably new concept to Sri Lanka.

Few

top corporate organizations in Sri Lanka already practice Green Accounting to a

very minor extent but on the other hand Green Accounting is still a novel

concept which illustrates a sluggish nature. The Institute of Chartered

Accountants in Sri Lanka hasn’t declared any Green Accounting Standards as yet;

hence Green Accounting practices will take many years to establish as a daily

practice in the corporate world Therefore this report will identify the existing

level of disclosure of green accounting practices in the corporate sector and

will determine its impact on organizational performance.

Company

annual reports derived from the conventional accounting framework don’t

disclose any environmental information and gives prominence solely to the

financial position of the organization. They do not at any point convey how the

corporate wishes to serve the environment. But a good green accounting

framework will reduce unnecessary pollution and provide better protection and

preservation to the environment from the negative effects of urban and

industrial development. Therefore it’s evident that Green Accounting is a must

for the corporate sector as their daily activities such as manufacturing,

transportation etc have made a great negative impact on the environment over

the years and they should take every possible step to preserve the environment.

1.3 Problem

Justification

According

to the Guardian (2009), American President Barack Obama’s Green Economy concept

paved the way for the development of a Green Economy to become on top of

America’s agenda.

With

the introduction of these reforms there has been an emerging trend of going

green all over the world. “With the growing green consumer awareness, companies

are more than ever expected to align its business strategies with environmental

initiatives. Environmentally conscious companies have already discovered that

they can generate business strategies to help them reduce their carbon

footprint, minimize their environmental impact, make the best use of natural

resources, become more energy efficient, reduce costs, and exhibit social

responsibility – all at the same time.” (Jhonson, 2009) The concept of Green

Accounting is based on the principle of using environmental information to

derive environmentally friendly decisions and business practices.

Nowadays

companies seem to be very much concerned about the environment however the real

challenge lies in applying these ideals in their day to day activities. However

“in Sri Lanka there is neither a professional standard nor legal framework

addressing the issue of environmental reporting”. (Pramanik et al, 2008)

Consequently although some of the top corporate sector organizations reveal

green accounting information in their annual reports, it is quite questionable

whether environmental information is taken into consideration for their day to

day activities and decision making. Hence before the implementation of such

theories, it is viable to identify the barriers to execute such policies and

how to overcome them to in order to boost the image of a corporate as well as

the overall image of the country.

1.4 Objectives of the study

1. To

find out the existing level of disclosure practices of green accounting among corporate sectors

2. To

determine the relationship of Green Accounting disclosure practices and organizational

performance

3. To

evaluate the barriers of implementing green accounting practices to the

corporate sectors

4. To

find out the relationship between demographic factors of the corporate sectors

and Green Accounting Disclosure Practices

5. To

identify the managers’ perception of the degree of Green Accounting involvement

in the corporate sector

6. To

find out the future investment capacity to implement the Green Accounting

practices in Sri Lankan Corporate Sectors

1.5 Significance of the Study

This study will bring about the perception that natural resources such as

water, soil, air and forests need to be treated explicitly at both the Micro

and Macro planning levels of the society. With the findings of this study the

corporate sector will find the existing level disclosure practices of green

accounting among the corporate sectors and the feasibility of introducing such

concepts to their workplace which will help them to develop a better corporate

image which will consequently lead to larger profits and stability in the long

run.

The findings of this study will affect the listed companies at a bigger

proportion as the sample for the study is based upon them and the success of

such implementation will be determined by the vision and mission of a

particular company.

When

considering the Government point of view, they will be able to examine the role

of natural resources in the sustainable development in the country and making

the most of the natural resources while harming the nature as less as possible.

Finally

when it comes to the community/society, they will be able to realize the impact

of development on the environment and the earth that we live in and they will

try to protect the environment with their maximum will.

1.6 Scope and limitations of the

study

Scope of the study

This study is a comparative analysis based on the concept of Green

Accounting. The proposed study will be conducted for a population derived from

the Colombo Stock Exchange listed companies in Sri Lanka.

Limitations

of the study

This

study topic calls for a broader sample since The Colombo Stock Exchange is home

to 238 companies. (CSE, 2010) However it isn’t practical to study Green

Accounting practices in-relation to all 238 companies. Therefore the study will

be conducted for the LMD top 50 companies for year 2008/2009 (LMD, 2010); with

more than 3 companies in each sector. However after categorizing the LMD top 50

companies into industry sectors, it is evident that not all 20 sectors are

represented. Hence the sample for the study will be limited to CSE listed companies

in the six sectors of Banking Finance and Insurance, Beverage food and Tobacco,

Diversified Holdings, Hotels and Travels, Manufacturing and Trading. Thereafter

their level of disclosure of Green Accounting Practices will be measured

through a questionnaire distributed among financial mangers as well as by

analyzing the company annual reports.

2. LITERATURE REVIEW

Accepting

this societal need today various companies in the world have already

implemented Green Accounting Practices. Tilt (2000), in her study about

environmental disclosure levels in Australian company’s reveal that The world

famous UK based pharmaceutical company Glaxo has a strong commitment to its

environment. However when it comes to the Asian Region, Yulon Nissan Motors is

one such company which is successfully involved in green accounting. (Hwa-Rong and Mei-Lynn, 2004).

When measuring the

level of disclosure of Green Accounting practices, many studies have considered

the company annual report as a form of disclosure. (Moneva and Lena, 2000;

Freedman and Jaggi, 1986; Staglino and Walden, 1998; Guthrie and Parker,1989;

Roberts, 1992: Hossain, Islam and Andrew,2006). In the next chapter the author

will be critically demonstrating the previous literature covering the topic of

the level of disclosure of green accounting practices in corporate sector.

The relationship

between the Organization size and the disclosure practices of Green Accounting

Andrew et al(1989)

in their study of the disclosure practices in Singapore and Malaysia found out

that a higher number of large and medium sized organizations revealed more

information when compared to smaller sized companies. Consequently Staglino and

Walden (1998) revealed positive association between the organization size and

the quantity of disclosure of green accounting practices. Similarly Cormier and

Magnan (1999), in their study about the determinants of corporate

environmental reporting by Canadian firms

subjected to water pollution regulations during the 1986-1993 era observed that

larger companies with better financial performance were obliged to disclose

environmental information. Additionally Lang and Lundlom, 1993, Nue et al, 1998,

Bewley and Li,2000 have also proved the relationship between the company size

and the level of disclosure of green accounting practices. (Magness, 2006)

Many researchers

have proved a positive relationship between the size of the company and the

amount of environmental disclosure in the annual reports of both developed and

developing nations. (Hossain, Islam and Andrew, 2006)

“However, other

researchers like Roberts (1992), Ng (1985) and Davey (1982) found that the size

of the company did not significantly explain an association with the level of

disclosure practices.” (Hossain, Islam and Andrew, 2006:4). Past studies done

by Glaum and Street (2003), Street and Bryant (2000), Street and Gray (2001)

and Tower et al. (1999) also support the above statement.(Lopes and

Rodrigus,2005)

The independent

variable of size has been measured in different aspects in different studies.

Measures of size used by past researchers were number of employees, total asset

value, total revenue etc. (Tilt, 2000: Hossain, Islam and Andrew, 2006:Lopes

and Rodrigues,2005)

Nevertheless Tilt

(2000) reveals that this doesn’t make a huge impact on the findings as the

particular variable is selected to ensure the non-biasness of data.

The relationship

between the Organization Industry/Sector and the disclosure practices of Green

Accounting

The industry of

the relevant organization is an independent variable which has been very

minutely used in similar studies in the past. It is one of the explanatory

variables for disclosure levels. (Hossain, Islam and Andrew, 2006)

Past researchers

have been able to critically identify both positive relationships between the

above stated variables; the findings have been summarized below.

ACCA (2010), in

its study about environmental reporting in Singaporean companies identified the

manufacturing sector as the main disclosing sector.

There are

significant differences between industries in both the quantity and quality of

environmental information reported (Adams et al., 1995; Gamble et al.,

1995; Jaggi and Zhao, 1996 cited in Moneva and Llena, 2000).

Thus, it is viable

to come to the conclusion that industries that do the most harm to the

environment will engage in more green activities and disclose higher portions

of green accounting practices. (Moneva and Llena, 2000 ; Ahmad, Sulaiman and

Siswantoro,2003)

“Hackston and

Milne(1996) report that disclosures are higher in, what they classify as, high

profile industries. On the other hand, Cowen et al. (1987), Adams et al. (1995

and 1998) and Freedman and Jaggi (1988) find that specific areas of disclosure

are related to industry sector.” (Gray et al, 2001: 330)

However it’s also

vital to outline that there have been instances where studies have been able

tro prove that there wasn’t any relationship between the two variables. Ahmad,

Sulaiman and Siswantoro (2003) upon studying annual reports of listed Malaysian

companies came to the conclusion that the level of disclosures regarding

company CSR activities didn’t vary across industries

The relationship

between the Organization Audit Firm and the disclosure practices of Green

Accounting

Chalmers and

Godfrey (2004), states High profile auditors are bound to demand high level of

environmental disclosure from their respective clients as a method of protecting

their reputation and status.

“Several studies

have examined empirically the relation between the characteristics of the audit

firm (size of audit firm or international link of the auditing firm) and the

extent of social and environmental

disclosure and found positive association between the audit firm size and the

level of disclosure. It is believed to be an important responsibility of

auditors to recommend their clients to practice socially responsible accounting

practices”. (Choi,1998 cited in Hossain, Islam and Andrew, 2006:5).

However

there have been both positive relationships and negative relationships between

the two variables in the past studies. The findings of Hodgdon (2004), Glaum

and Street (2003) and Street and Gray (2001) found a positive significant

Relationship

while Chalmers and Godfrey (2004) and Abd-Elsalam and Weetman (2003) found

mixed results regarding this variable. (Lopes and Rodrigues,2005)

“Fry and Mock

(1976), Belkaoui and Karpik (1989) and Hackston and Milne (1996) find no

relationship whilst Freedman and Ullmann (1986) and Freedman and Jaggi (1988)

find either no relationship or an inverse relationship”. (Gray et al,2001:330)

Bowman (1978,

cited in Gray et al, 2001) finds a positive relationship between environmental disclosure

and financial performance whilst Roberts (1992, cited in Gray et al, 2001)

cautiously concludes that a insulated relationship exists between these two variables.

A positive

association between profitability and the extent of corporate social and

environmental disclosure were empirically proved in work by Trotman and Bradley

(1981), Roberts (1982), Belkaoui and Karpik (1989), Adams et al. (1995 and

1998) and Hackston and Milne (1996). (Hossain, Islam and Andrew, 2006 ; Gray et

al, 2001:330)

The relationship

between the Organization Culture (westernization) and the disclosure practices

of Green Accounting

It is believed that

“the more internationalized a company is the more it has to show its

stakeholders (customers, suppliers, government) that it is a good company.” (Lopes

and Rodrigues,2005: 11)

And when a company

is international or rather has international ties, irrespective of the fact whether

they import, export or have subsidiaries worldwide, it is quite clear that they

have to acquire international standards in their day to day activities.

Therefore they have to adhere to a certain set of standards since western

countries have a very through framework for accounting where the standards are

quite high. Although Green Accounting isn’t a day to day practice in Sri Lanka,

it is an emerging trend in the world. Hence it’s clear that the Organization

culture has an impact on the level of disclosure of green accounting practices.

However Lopes and

Rodrigues (2005) could not pinpoint a clear relationship between the levels of

internationalization and the disclosure of practices in the Portuguese stock

exchange; consistently to the findings of Street and Gray (2001, cited in Lopes

and Rodrigues, 2005)

The relationship

between the Corporate governance and the disclosure practices of Green

Accounting

Lopes and

Rodrigues (2005:12) states that “Both agency and contingency theories conduct

us to think that corporate governance structure of the company may be related

to reporting practices, specifically to disclosure practices.”

However Haniffa

and Cooke (2002, cited in Lopes and Rodrigues, 2005) declares that independent

directors are needed on the boards to monitor and control the actions of the

other executive managers.

“So, board

composition may be an interesting variable to consider because it will reflect

the role of independent directors. It can be expected more disclosure for

companies with higher proportion of independent directors, once they are

outside to the company and will force management to disclose. On the other

hand, if the board has a high proportion of non-independent directors, it can

be expected less disclosure, once they have access to inside information.”

(Lopes and Rodrigues, 2005:12-13)

However the study

conducted by Lopes and Rodriguez couldn’t show evidence on a positive

relationship between corporate governance and disclosure of practices’. (Lopes

and Rodrigues, 2005)

3. RESEARCH METHODOLOGY

3.1 Conceptual

Framework

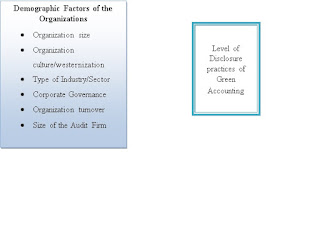

Independent

Variable Dependent Variable

3.2 List of

Hypothesis formulated

|

|

Hypothesis

|

|

1

|

Ho 1-There is no relationship between

the organization size and the level of disclosure practices of green

accounting

|

|

Ha 1-There is a relationship between the

organization size and the level of disclosure practices of green accounting

|

|

|

2

|

Ho 2-There is no relationship between

the organization culture and the level of disclosure practices of green

accounting

|

|

Ha 2-There is a relationship between the

organization culture and the level of disclosure practices of green

accounting

|

|

|

3

|

Ho 3-There is no relationship between

the organization industry and the level of disclosure practices of green

accounting

|

|

Ha 3-There is a relationship between the

organization industry and the level of disclosure practices of green

accounting

|

|

|

4

|

Ho4-There is no relationship between the

Corporate Governance of the organization and the level of disclosure practices

of green accounting

|

|

Ha 4-There is a relationship between the Corporate

Governance of the organization and the level of disclosure practices in green

accounting

|

|

|

5

|

Ho 5-There is no relationship between

the organization turnover and the level of disclosure practices of green

accounting

|

|

Ha 5-There is a relationship between the

organization turnover and the level of disclosure practices in green

accounting

|

|

|

6

|

Ho 6-There is no relationship between

the audit firm for the organization and the level of disclosure practices of

green accounting

|

|

Ha 6-There is a relationship between the

audit firm for the organization and the level of disclosure practices in

green accounting

|

3.3 Population

This

study will be conducted for 238 CSE listed companies (CSE, 2010) covering 20

sectors. However since the population is broad, it will be further narrowed

down to a target population of Top 50 LMD companies for year 2008/2009 (LMD,

2010).

3.4 Sample

The

sampling method for the study will be stratified systematic simple random

sampling. The top 50 LMD companies will be categorized into groups according to

the relevant sectors. (Based on the CSE companies- list by industry/ sector) (Refer

appendix A)

Furthermore

after categorizing the companies into the relevant sectors, each sector with

three or more companies will be selected for the sample. (Refer appendix B for

the list of the companies) Therefore the sample for the study will consist of

40 organizations covering six sectors.

Selected

number of companies from each sector

|

Sector

|

Number of

Organizations

|

|

Bank, Finance

and Insurance

|

|

|

Beverage, food

and Tobacco

|

07

|

|

Diversified

Holdings

|

07

|

|

Hotels and

Travels

|

03

|

|

Manufacturing

|

06

|

|

Trading

|

04

|

|

Source: Author’s

work

However

in the process of data collection, a questionnaire based on the objectives and

the conceptual framework of the study will be developed to evaluate the

independent and dependent variables and will be distributed among the finance

managers of the 40 companies in the sample. (Refer Appendix C) Parallel to

this, the annual reports of the companies from year 2005-2010 will be analyzed

in order to attain an understanding about their disclosure practices of green

accounting.

Population and Sample

3.5 Operationalization of

Variables

|

Type of the variable

|

Name of the Variable

|

Definition

|

Measurement of data

|

|

Independent Variable

|

Organization size

|

The number of employees working in the company

|

Ratio

|

|

Type of Industry/Sector

|

What sort of operations does the company engage in

|

nominal

|

|

|

Organization culture

|

Behavior patterns of the employees

|

Interval

|

|

|

Corporate Governance

|

Number of Independent Directors

|

ratio

|

|

|

Organization turnover

|

Income generated by the organization

|

ratio

|

|

|

Audit Firm

|

The number of employees working for the Audit Firm

|

ratio

|

|

|

Dependent variable

|

Level of disclosure practices of Green Accounting

|

To what extent do they reveal Green Accounting practices

|

Interval

|

Source-

Author’s work

3.6 Proposed Statistical Method

When

considering the variables used in the conceptual Framework, it can be

identified that ANOVA (analysis of variances) is the best method to analyze the

statistics. Similar studies done by Lopes and Rodrigues (2005), and

Moneva and Llena (2000) have used the same statistical method. Therefore the

author will be using the same method to analyze statistics.

REFERENCES

Cormier, D. and Magnan, M. (1999),

“Corporate environmental disclosure strategies:

determinants, costs and benefits”, Journal

of Accounting, Auditing and Finance, pp. 429-51.

Jahamani,Y.F,(2003), Green Accounting in Developing Countries: The

Case of U.A.E. and Jordan, Accounting Journal, Vol.29, No.08, pp. 29-38

Stanojevic,M.Vranes,S and GokalP,

I. (2010), Green accounting for greener energy, Renewable and Sustainable Energy Reviews,pp 30

Hossain,M. Islam,K. and Andrew,J.(2003),

Corportae Social Environmental

Disclosure in Developing Countries:Evidence from Bangaldesh, Faculty of Commerce Papers,

Staglino,A. and Walden,D.(1998), assessing the quality of Environmental

Disclosure Themes.USA

Rajapakse, B. (2003). Environmental

Reporting Expectation Gap: Evidence from Private Sector Organizations in Sri

Lanka. IWE Journal, 3, 99 -199.

Pramanik,A.Shil,N. Das,B., (2008).

Corporate Environmental Reporting:An emerging issue in the corporate. International

Journal of business management, Vol 3, No.12

Tilt,C., (1998). Corporate The content and

disclosure of Australian corporate environmental policies: Accounting, Auditing

& Accountability Journal.,PP 90 -120

Lopes,P and Rodrigues,L. (2005). ACCOUNTING FOR FINANCIAL INSTRUMENTS: AN

ANALYSIS OF THE DETERMINANTS OF DISCLOSURE IN THE PORTUGUESE STOCK EXCHANGE.

Chalmers, K. and J. Godfrey (2004),

"Reputation Costs: The Impetus for Voluntary

Derivative Financial Instrument

Reporting", Accounting, Organizations and Society,

Vol. 29, 2, pp. 95-125.

Gray,R,

Javad,M., Power,D and Sinclaire C (2001). Social and Environmental

Disclosure and Corporate Characteristics:

A Research Noteand Extension. Journal of Business Finance &"

Accounting, vol 28(3) & (4).pp 327-356

Ahmad,N. Sulaiman,M and

Siswantoro,D. CORPORATE

SOCIAL RESPONSIBILITY DISCLOSUREIN MALAYSIA: AN ANALYSIS OF ANNUAL REPORTS OF

KLSE LISTED COMPANIES. IIUM Journal of Economics and Management.Vol 11,1

Moneva, J

and Llena, F (2000) Environmental disclosures in the

annual reports of large companies in Spain. The

European Accounting Review 2000, 9:1, pp7-29

Glaum, M. and D. Street (2003),

"Compliance with the Disclosure Requirements of

Germany's New Market: IAS versus US

GAAP", Journal of International Financial

Management & Accounting,

Vol. 14, 1, pp. 65-100.

Street, D. and S. Bryant (2000),

"Disclosure Level and Compliance with IASs: A Comparison of Companies With

and Without US Listings and Fillings", The International Journal of

Accounting, Vol. 35, 3, pp. 305-329.

Street, D. and S. Gray (2001), Observance

of International Accounting Standards: Factors Explaining Non-compliance, ACCA

Research Report nº 74, ed.: London Certified Accountants Educational Trust.

Tower, G., P. Hancock and R. Taplin

(1999), "A regional study of listed companies'

compliance with international accounting

standards", Accounting Forum, Vol. 23, 3,

pp. 293-305.

Cormier,D and Magnan, M(1999) orporate Environmental Disclosure Strategies: Determinants,

Costs and Benefits.

Journal of Accounting, Auditing & Finance, Vol 14, No 4

Journal of Accounting, Auditing & Finance, Vol 14, No 4

Freedman, M. and Jaggi, B. (1988), “An

analysis of the association between pollution disclosures and economic

performance”, Accounting, Auditing & Accountability Journal, Vol. 1, pp.

43-58.

Guthrie, J. and Parker, L. (1989),

“Corporate social reporting: a rebuttal of legitimacy theory”, Accounting and

Business Research, Vol. 19, pp. 343-52.

APPENDICES

APPENDIX A

LMD Top 50

companies categorized into the relevant industry sectors

|

Sector

|

Company

|

|

Bank, Finance and Insurance

|

1.

Commercial

Bank of Ceylon PLC

2.

Hatton

National Bank PLC

3.

Seylan

Bank

4.

Sampath

Bank

5.

Ceylinco

Insurance PLC

6.

Central

Finance Company PLC

7.

Nations

Trust Bank

8.

Lanka

Orix Leasing Company

9.

DFCC

Bank

10.

National

Development Bank PLC

11.

AVIVA

NDB Insurance PLC

(Eagle insurance)

12.

Union

Assuarance PLC

13.

Janashakthi

Insurance Company PLC

|

|

Beverage, food and Tobacco

|

1. Cargills Ceylon PLC

2. Distilleries Company of Sri Lanka PLC

3. Nestle Lanka

4. Ceylon Cold Stores PLC

5. Ceylon Tobacco Company PLC

6. Ceylon Brewery PLC

7. Ceylon Tea Services PLC

|

|

Sector

|

Company

|

|

Chemicals and Pharmaceuticals

|

1. Chemical Industries Colombo PLC (CIC)

|

|

Construction and Engineering

|

1. Colombo Dockyard PLC

|

|

Diversified Holdings

|

1. John Keels Holdings PLC

2. Ceylon Theatres PLC

3. Hayleys PLC

4. Aitken Spence PLC

5. Richard Pieris and Company PLC

6. Hemas Holdings PLC

7. Sunshine Holdings PLC

|

|

Footware and Textile

|

1. Hayleys MGT Knitting Mills PLC

2. Kuruwita Textile Mills PLC

|

|

Hotels and Travels

|

1. Aitken Spence Hotel Holdings PLC

2. John Keels Hotels PLC

3. Asian Hotels and Properties PLC

|

|

Manufacturing

|

1. Tokyo Cement Company PLC

2. Dipped Products PLC

3. Chevron Lubricants Lanka PLC

4. ACL Cables PLC

5. Ceylon Grain Elevators PLC

6. Lanka Ceramic PLC

|

|

Motors

|

1. Diesel and Motor Engineering PLC (DIMO)

2. United Motors Lanka PLC

|

|

Sector

|

Company

|

|

Oil Palms

|

1. Bukit Darah PLC

|

|

Power and Energy

|

1. Lanka IOC

PLC

|

|

Telecommunication

|

1.

Sri

Lanka Telecom PLC

2.

Dialog

Axiata PLC

|

|

Trading

|

1.

Singer

Sri Lanka PLC

2.

Brown

and Company PLC

3.

C.W.Mackie

PLC

4.

Haycarb

PLC

|

Source: Author’s work based on LMD (2010) and CSE

(2010)

APPENDIX B

Selected sample of 40 companies based on the LMD

top 50 ratings

This sample includes every sector with more than

three organizations in the LMD top 50 list.

|

Sector

|

LMD Top 50 companies belonging to the selected sectors

(turnover is in descending order)

|

|

Bank, Finance and Insurance

|

1.

Commercial

Bank of Ceylon PLC

2.

Hatton

National Bank PLC

3.

Seylan

Bank

4.

Sampath

Bank

5.

Ceylinco

Insurance PLC

6.

Central

Finance Company PLC

7.

Nations

Trust Bank

8.

Lanka

Orix Leasing Company

9.

DFCC

Bank

10.

National

Development Bank PLC

11.

AVIVA

NDB Insurance PLC

(Eagle insurance)

12.

Union

Assuarance PLC

13.

Janashakthi

Insurance Company PLC

|

|

Beverage, food and Tobacco

|

1.

Cargills

Ceylon PLC

2.

Distilleries

Company of Sri Lanka PLC

3.

Nestle

Lanka

4.

Ceylon

Cold Stores PLC

5.

Ceylon

Tobacco Company PLC

6.

Ceylon

Brewery PLC

7.

Ceylon

Tea Services PLC

|

|

Diversified Holdings

|

1.

John

Keels Holdings PLC

2.

Ceylon

Theatres PLC

3.

Hayleys

PLC

4.

Aitken

Spence PLC

5.

Richard

Pieris and Company PLC

6.

Hemas

Holdings PLC

7.

Sunshine

Holdings PLC

|

|

Hotels and Travels

|

1.

Aitken

Spence Hotel Holdings PLC

2.

John

Keels Hotels PLC

3.

Asian

Hotels and Properties PLC

|

|

Manufacturing

|

1.

Tokyo

Cement Company PLC

2.

Dipped

Products PLC

3.

Chevron

Lubricants Lanka PLC

4.

ACL

Cables PLC

5.

Ceylon

Grain Elevators PLC

6.

Lanka

Ceramic PLC

|

|

Trading

|

1.

Singer

Sri Lanka PLC

2.

Brown

and Company PLC

3.

C.W.Mackie

PLC

4.

Haycarb

PLC

|

Source: Author’s work based on CSE (2010)

APPENDIX

C

Questionnaire to be distributed among the financial

managers of the selected 40 organizations

1. Name of the Organization-

2. Name of the Respondent-

3. Position Held-

4. Relevant Industry-

5. Number of employees in your division/department

6. Number of employees in the organization-

7. The turnover for the past year

8. Name of the company audit firm

9. For how long has the company been using this

auditor